Condo Insurance in and around Crescent City

Welcome, condo unitowners of Crescent City

State Farm can help you with condo insurance

Your Belongings Need Insurance—and So Does Your Condo.

The life you treasure is rooted in the condo you call home. Your condo is where you recharge, rest and relax. It’s where you build a life with the ones you love.

Welcome, condo unitowners of Crescent City

State Farm can help you with condo insurance

Agent Mary Dorman, At Your Service

You want to protect that important place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as hail, theft or wind. Agent Mary Dorman can help you figure out how much of this terrific coverage you need and create a policy that is right for you.

Don’t let fears about your condo keep you up at night! Reach out to State Farm Agent Mary Dorman today and explore how you can meet your needs with State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

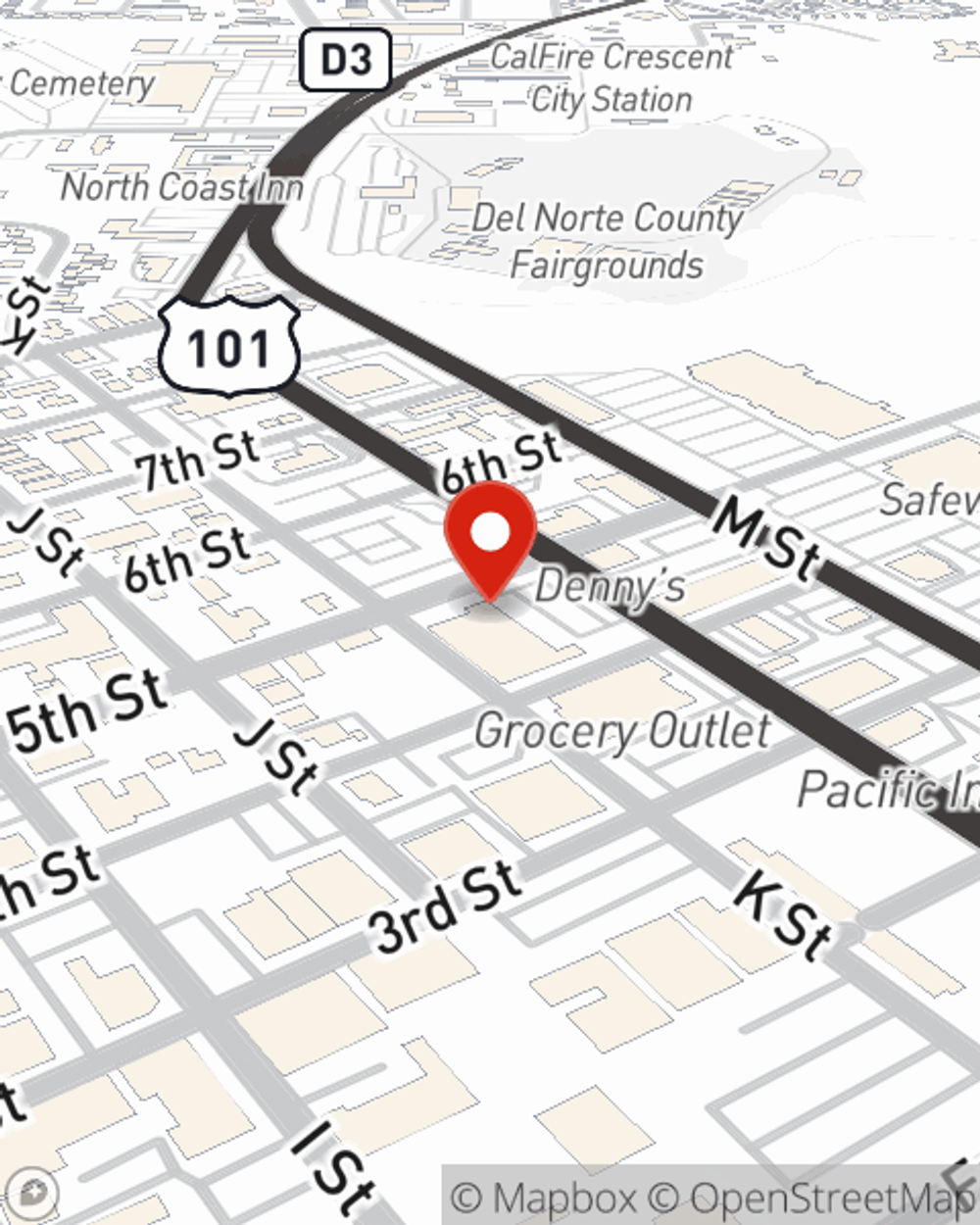

Call Mary at (707) 464-2414 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Mary Dorman

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.